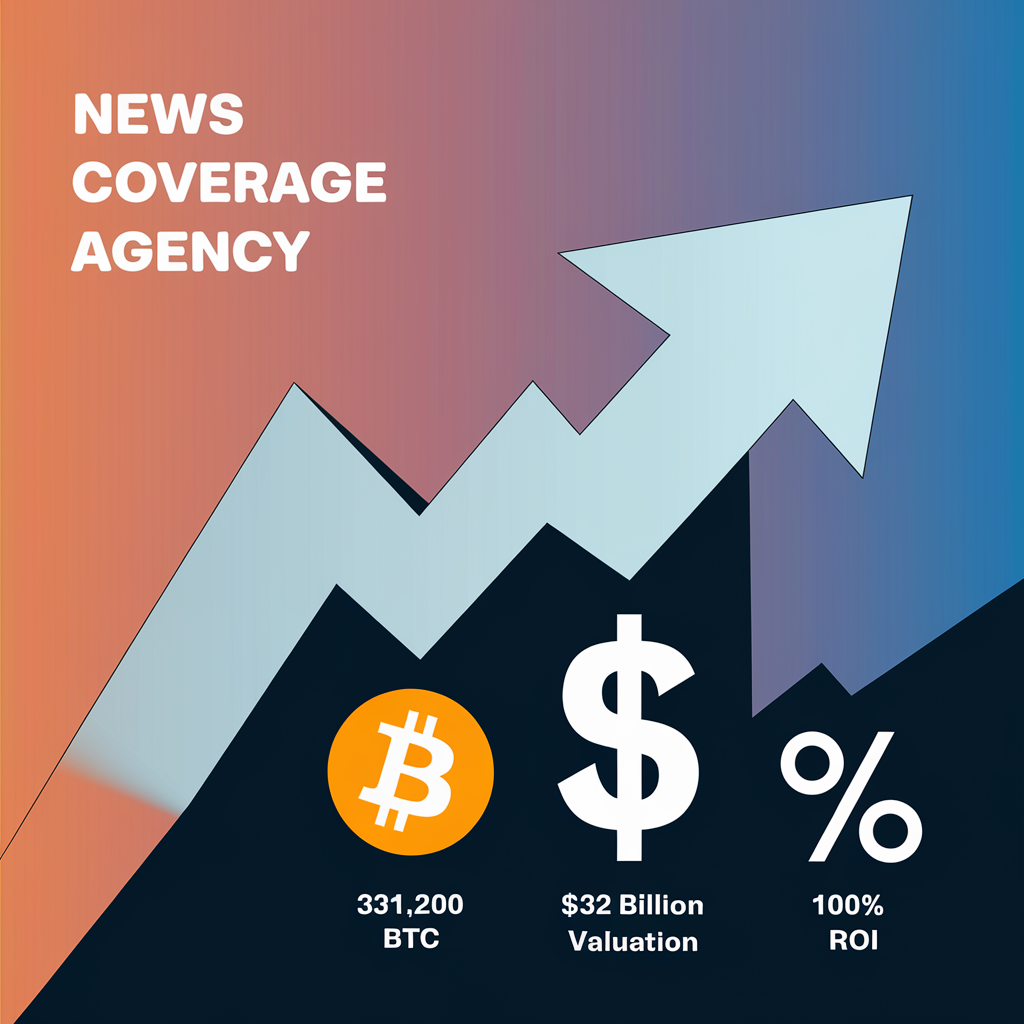

MicroStrategy, the business intelligence firm led by Michael Saylor, has achieved a remarkable milestone with its Bitcoin holdings now exceeding $20 billion. The company’s return on investment (ROI) has surpassed 100%, showcasing a bold strategy that has turned heads in the financial world. At News Coverage Agency, we understand the implications of such developments and offer tailored marketing strategies to help businesses thrive in this dynamic environment.

MicroStrategy’s Bold Bitcoin Strategy

Since adopting a Bitcoin reserve strategy in 2020, MicroStrategy has made headlines for its aggressive accumulation of the cryptocurrency. As of now, the company holds approximately 331,200 BTC, valued at around $32 billion based on current market prices. This significant investment reflects Saylor’s unwavering belief in Bitcoin as a hedge against inflation and a core asset for corporate treasuries.

Must read-The Importance of Cryptocurrencies on Social Media and Digital Marketing

Key Highlights of MicroStrategy’s Bitcoin Holdings

- Total Holdings: 331,200 BTC

- Current Value: Approximately $32 billion

- Average Acquisition Cost: Roughly $49,874 per BTC

- Total Investment: About $16.5 billion

This strategy has not only increased MicroStrategy’s market capitalization but has also positioned it as a leader in corporate Bitcoin adoption.

The Financial Upsurge: What It Means

MicroStrategy’s recent financial performance is staggering. The company reported generating approximately $500 million daily as Bitcoin prices approached the $100,000 mark. This impressive revenue stream highlights the potential profitability of a well-executed cryptocurrency strategy.

| Metric | Value |

|---|---|

| Daily Revenue | $500 million |

| Year-to-Date Stock Increase | 620% |

| Current Stock Price | ~$482 |

| Market Capitalization | ~$111 billion |

These figures illustrate not only the success of MicroStrategy’s investments but also the broader implications for investors looking to capitalize on the cryptocurrency boom.

Navigating Risks and Rewards

While MicroStrategy’s strategy has yielded significant returns, it is not without risks. The company’s stock is currently trading at a staggering 256% premium to its Bitcoin holdings’ net asset value (NAV). This disparity raises questions about sustainability and investor sentiment.

Potential Risks:

- Market Volatility: Cryptocurrency markets are notoriously volatile, and significant price drops could impact MicroStrategy’s financial health.

- Regulatory Scrutiny: As more companies adopt Bitcoin, regulatory bodies may impose stricter guidelines that could affect operations.

- Investor Sentiment: A shift in investor confidence could lead to rapid sell-offs, impacting stock prices dramatically.

Personal Experience: Adapting to Market Changes

Reflecting on my experience at News Coverage Agency, I recall a time when we had to pivot our marketing strategies due to sudden shifts in market dynamics. We focused on educating our clients about emerging trends while providing them with data-driven insights to navigate uncertainties. This adaptability is crucial in today’s fast-paced financial landscape.

How News Coverage Agency Can Support Your Business

At News Coverage Agency, we specialize in delivering comprehensive digital marketing solutions tailored to your unique needs. Our services include:

- SEO and Content Marketing: We create engaging content that educates your audience about market trends and positions your brand as an industry leader.

- Data Analytics and Reporting: Our team focuses on measurable results, ensuring you can track ROI and make informed decisions about your marketing strategies.

- Social Media Management: We help you build a strong online presence that resonates with your target audience and enhances brand loyalty.

The Future of MicroStrategy and Bitcoin

As we look ahead, analysts predict that if Bitcoin reaches the coveted $100,000 mark, MicroStrategy’s profits could exceed $10 billion. This projection underscores the potential for continued growth in both the cryptocurrency market and MicroStrategy’s stock performance.

Factors Influencing Future Growth:

- Increased Institutional Adoption: As more institutions recognize Bitcoin’s value, demand is likely to rise.

- Technological Advancements: Innovations in blockchain technology could enhance Bitcoin’s utility and security.

- Market Sentiment: Positive news cycles surrounding cryptocurrency can drive investor interest and increase prices.

Conclusion

MicroStrategy’s journey with Bitcoin exemplifies both the risks and rewards associated with cryptocurrency investments. As the company continues to innovate and adapt its strategies, businesses must also remain agile in their marketing approaches. At News Coverage Agency, we are dedicated to helping you navigate these complexities with confidence through our expert marketing services designed for success