In the ever-evolving landscape of finance, decentralized finance (DeFi) has emerged as both a beacon of hope and a source of anxiety for many. The allure of a financial system built on transparency, accessibility, and autonomy is undeniable. However, as with any revolutionary idea, there are pitfalls and realities that often get swept under the rug. In this blog, we’ll explore the dual nature of DeFi, examining both its exciting potential and its inherent risks.

The Allure of DeFi

DeFi has been dubbed the “financial revolution” because it aims to disrupt traditional banking systems by providing users with direct access to financial services without intermediaries. Imagine a world where you can lend, borrow, trade, and earn interest on your assets without the constraints of a bank. This dream is powered by blockchain technology, which offers a level of security and transparency previously unseen in finance.

At its core, DeFi is about empowering individuals. Anyone with an internet connection can participate in this financial ecosystem. This accessibility is one of DeFi’s most significant selling points. It democratizes finance, allowing the unbanked or underbanked to engage in economic activities that were once out of reach.

I remember my first foray into DeFi. It was thrilling to swap tokens on a decentralized exchange and earn interest on my holdings through yield farming. The thrill of being part of a movement that promised to upend the status quo was intoxicating. However, my initial excitement was soon tempered by the realization of how unregulated and volatile this space could be.

The Dark Side of DeFi

While the potential benefits of DeFi are alluring, the space is fraught with challenges and risks that can lead to significant losses. One of the most pressing issues is security. DeFi platforms are often targeted by hackers due to their inherent vulnerabilities. According to a report by Chainalysis, over $1.3 billion was stolen from DeFi platforms in 2021 alone. This statistic serves as a stark reminder that while DeFi offers revolutionary possibilities, it also comes with significant risks.

Moreover, the lack of regulatory oversight can lead to scams and misleading projects. The infamous “rug pull” is a phenomenon where developers abandon a project after attracting investment, leaving investors with worthless tokens. The decentralized nature of these platforms makes it challenging to recover funds, leading many to lose their investments.

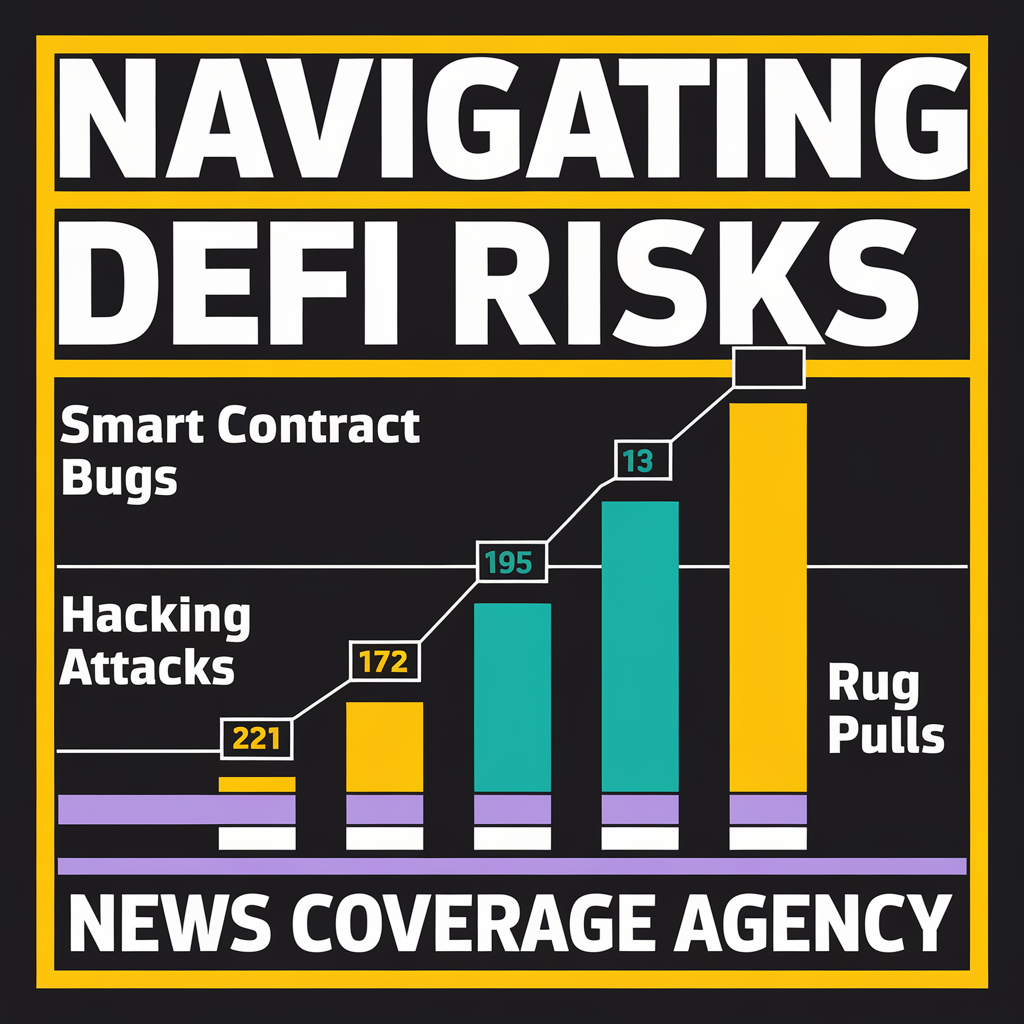

Here’s a table summarizing the security risks associated with DeFi:

| Risk Type | Description | Potential Impact |

|---|---|---|

| Smart Contract Bugs | Vulnerabilities in code that can be exploited. | Loss of funds; inability to recover assets. |

| Hacking Attacks | Malicious actors exploiting weaknesses in DeFi platforms. | Significant financial losses. |

| Rug Pulls | Developers abandon projects after raising funds. | Investors lose their entire investment. |

| Market Volatility | Sudden price changes can lead to losses. | Forced liquidation of assets. |

The Hype and Reality

The marketing of DeFi projects often leans heavily on the utopian vision of a decentralized future, promising astronomical returns and financial freedom. However, this hype can lead to unrealistic expectations. Many newcomers enter the space believing they will quickly become wealthy without fully understanding the underlying technologies or the risks involved.

An example of this is the rise and fall of various tokens during the initial coin offering (ICO) craze. Investors were lured by the promise of substantial returns, only to find themselves holding depreciated assets as the market corrected itself. The disparity between the marketing narrative and actual outcomes can be jarring, and it’s crucial for investors to conduct thorough research before diving in.

must read-From FUD to FOMO: Mastering Emotional Marketing in the Crypto Space

Navigating the DeFi Landscape

For those who are still intrigued by the potential of DeFi, it’s essential to approach the space with caution and awareness. Here are a few tips to help navigate the DeFi landscape effectively:

- Educate Yourself: Before investing, take the time to understand how DeFi works, including the underlying technologies and potential risks.

- Start Small: Begin with a small investment to familiarize yourself with the processes involved. This minimizes your risk while you learn.

- Diversify: Don’t put all your eggs in one basket. Spread your investments across different platforms and projects to mitigate risk.

- Use Reputable Platforms: Stick to well-known DeFi platforms with a track record of security and user trust.

- Stay Informed: Keep up with the latest news and trends in the DeFi space. The landscape is constantly evolving, and being informed can help you make better decisions.

What We Offer at News Coverage Agency

At News Coverage Agency, we understand the challenges and opportunities presented by the rapidly changing digital marketing landscape, especially in the realm of DeFi. We are a strategically minded, creatively fueled marketing agency dedicated to helping businesses navigate this complex environment.

We offer a full suite of services designed to enhance your digital presence, from creating compelling content to executing effective SEO and PPC campaigns. Our team of experts is committed to delivering measurable results that connect with your target audience and drive business growth.

Here’s how we can assist you:

- Content Creation: We develop engaging and informative content that resonates with your audience and establishes your authority in the DeFi space.

- SEO Services: Our SEO strategies are tailored to improve your visibility and rankings in search engines, ensuring that potential customers find you easily.

- PPC Campaigns: We create targeted ad campaigns that maximize your ROI, driving traffic and conversions.

- Digital Marketing Strategy: Whether you’re launching a new product or looking to enhance your brand’s online presence, we can craft a comprehensive marketing strategy that aligns with your business goals.

Conclusion

The journey into DeFi can be both exhilarating and daunting. As we explore the potential for a decentralized financial future, it’s crucial to recognize the inherent risks and approach this space with a balanced mindset. By educating ourselves and making informed decisions, we can harness the benefits of DeFi while navigating its challenges.

In the end, whether DeFi becomes a dream or a nightmare largely depends on our approach to it. As we look to the future, let’s strive for a balanced perspective that embraces innovation while remaining vigilant about the pitfalls that can accompany it.